Columbia University

Expected Dec. 2026

Operations Research Financial Engineering - GPA: 4.0

Recent Projects

June 2024 - Present

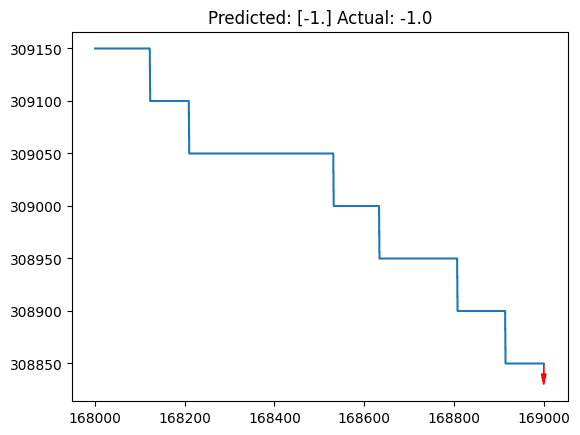

Price Prediction model utilizing LightGBM regressor based on top of orderbook feeds.

Features

- 0.52 R^2 (Strong Enough) on test dataset.

- Engineered common High Frequency Trading Labels such as Top of Orderbook Imbalance, midprice, and spread.

- Feature engineering via lag, and rolling methods.

- Generates all dataset labels in near real-time utilizing Dynamic Programming to cache frequent access results.

- Parses real world data provided by LOBSTER Data to replicate real world order intensities.

May - June 2024

Implemented the Queue-reactive model in python to simulate a real orderbook to predict probability of execution for high frequency trading (hft) algorithms.

Features

- Capable of processing 100,000 orders a second using a fast Limit Orderbook Implementation utilizing AVL Trees

- Parses real world data provided by LOBSTER Data to replicate real world order intensities.

- Vectorized all data computations to run in near-instant time utilizing Dynamic Programming to cache frequent access results

Dec. 2023 - Jan. 2024

A neural network coded in c++, utilizing no machine learning libraries.

Features

- 95% out of sample accuracy on MNIST dataset using a 3 layer neural network

- 784 input nodes, 128w hidden nodes, 10 output nodes

- Implemented RELU activation function for hidden layer, Softmax for output layer

- Cross Entropy Loss Function

- Trained on MNIST dataset